introducing mortgage one-eighty

Award-winning mortgage repayment strategy

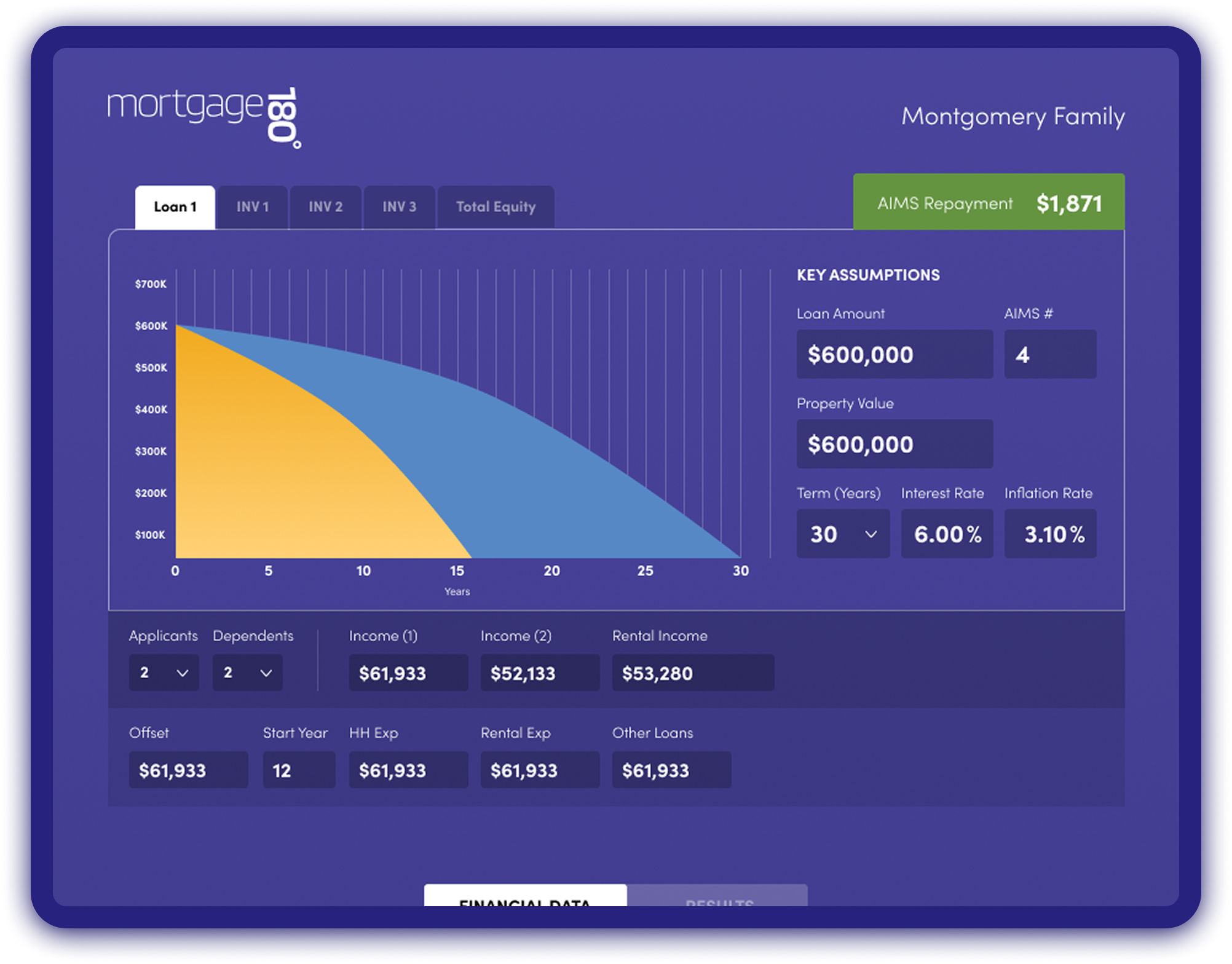

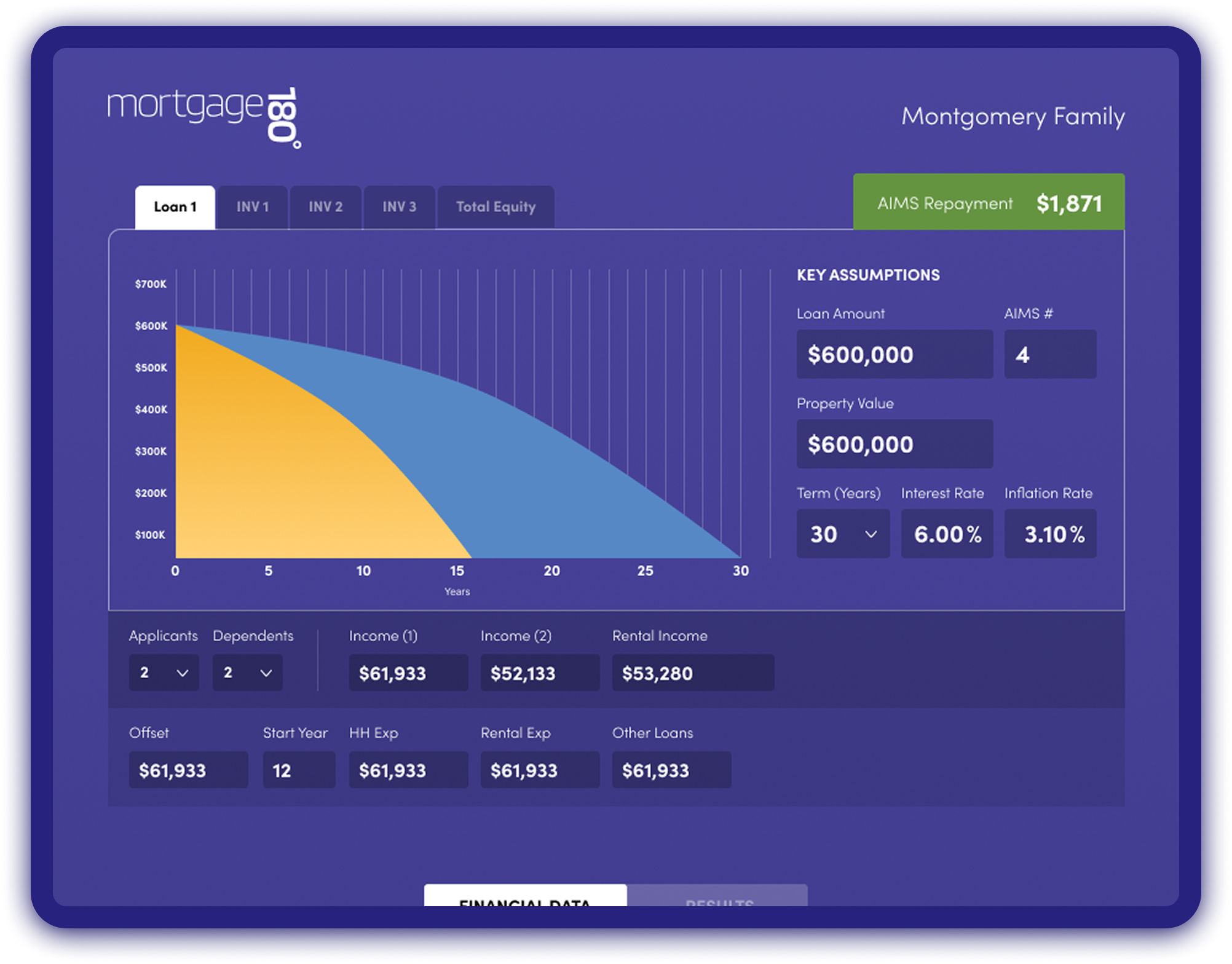

Our process helps homeowners pay off their home loan in less than half the usual time—without impacting their household budget.

Adjusts payments gradually, so increases feel effortless

Unlock opportunities for wealth creation and investments

Free access for all MoneySmith mortgage customers

Look at owning your home in less than half the usual time

You stay in control, and repayments adjust in a way that won’t disrupt your budget

Copyright 2025. All rights reserved. MoneySmithGroup. Disclaimer | United States|Disclaimer | Australia